3-minute read

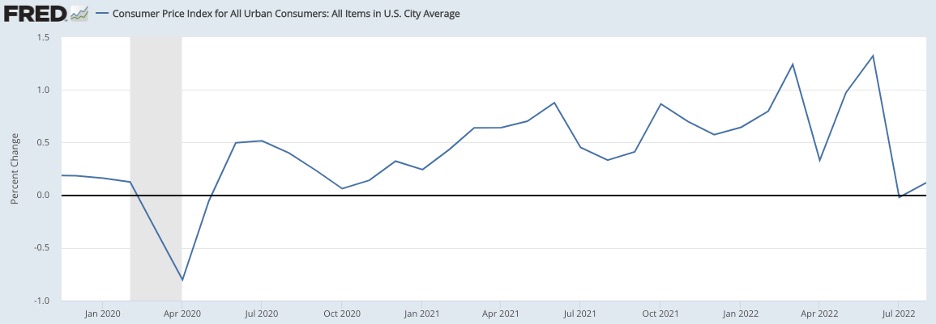

This year has been spurred by supply chain shortages, loose monetary and fiscal policy, as well as pent-up consumer demand from pandemic lockdowns. Inflation surged to the highest level since 1981. The Consumer Price Index, the Federal Reserve’s preferred inflation indicator, increased by 9.00% during the 12 months leading up to June 2022. In contrast, the typical inflation rate is 2.00%.

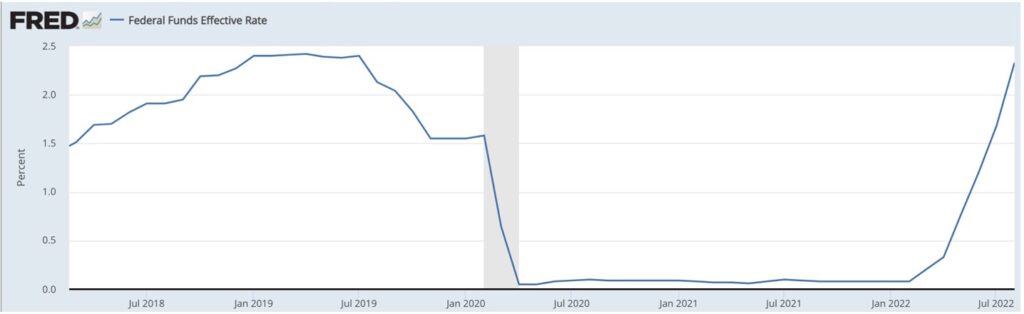

Regarding inflation, Fed Chair Jerome Powell remarked, “The Fed has the responsibility for price stability, by which we mean 2% inflation over time. The longer inflation remains well above target, the greater the risk. The public does begin to see higher inflation as the norm, and that has the capacity to raise the costs of getting inflation down.” In an effort to quell inflation, the Federal Reserve began increasing interest rates.

The Federal Reserve is anticipated to continue increasing interest rates through 2023. Federal Reserve policymakers have made it clear that they will continue monitoring inflation data, with the goal of slowing down interest rate hikes once inflation begins to normalize.

Recent CPI data shows that inflation is no longer growing at the same rate as in prior months.

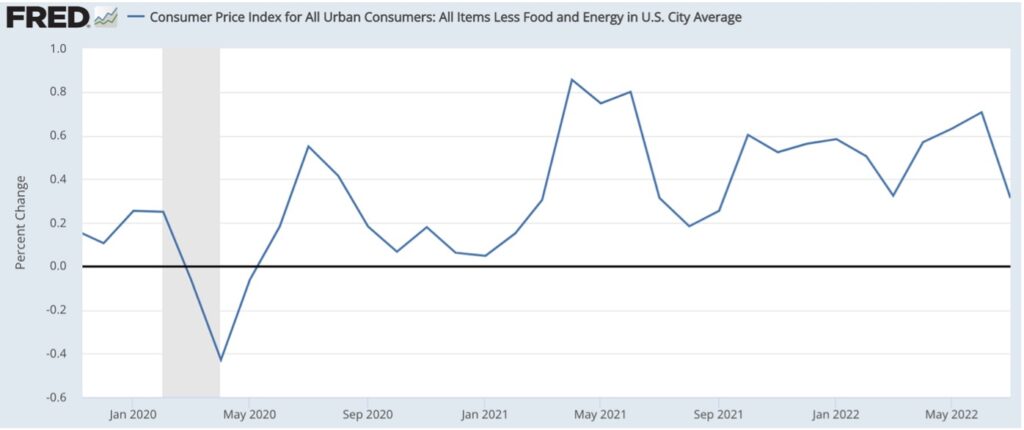

Admittedly, the July decrease in CPI was largely due to a decrease in fuel prices. In July 2022 fuel prices decreased by 11.0%. This decrease in fuel prices helped offset increases in prices for food, electricity, and other CPI components. During a period of volatile commodity prices, it is often more valuable to review core CPI data, which strips out food and energy from the index.

Overall, while inflation continues to run above target levels, it appears that inflation is beginning to subside.

The small decrease in the all items CPI for July 2022 was the lowest level since May 2020, yet was skewed due to falling fuel prices. The 0.31% increase in the core inflation rate for July 2022 was the smallest increase since September 2021. While the Fed will likely closely monitor upcoming CPI releases before shifting their strategy, the July 2022 CPI data shows a softening of inflation and may indicate a shift in the broader inflation trend.

Related Reading: Our 2022 Mid Year Economic Review