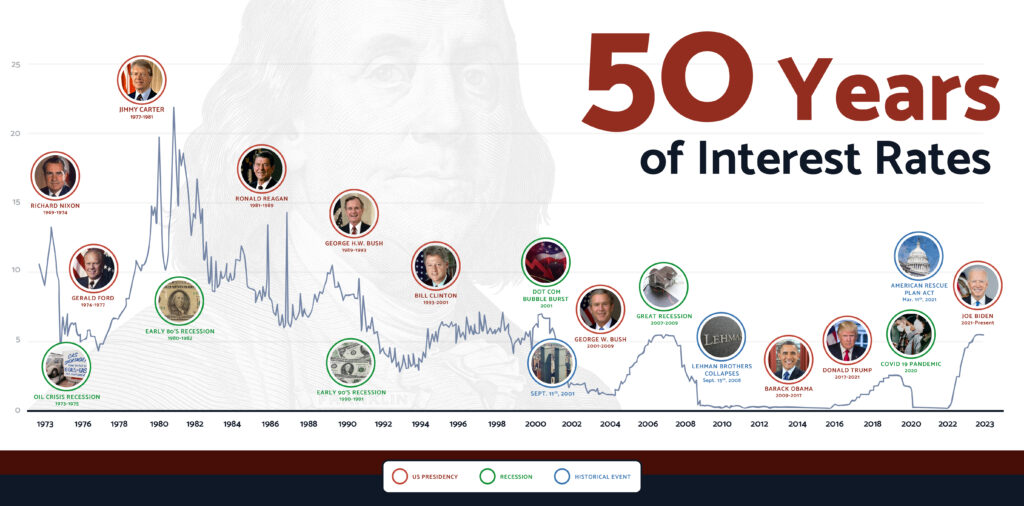

Interest rates, the backbone of modern economies, have shaped the financial landscape over the past five decades. From the rollercoaster ride of the 1970s to the era of historic lows in the 2010s, the trajectory of interest rates influences borrowing, lending, investment, and economic growth on a global scale.

This article takes a comprehensive look at the fluctuations and trends in interest rates over the last 50 years, offering insights into the factors that have driven these changes and the implications they hold for individuals, businesses, and governments alike.

The 1970s and 1980s: Turbulence

The 1970s marked a period of economic upheaval, characterized by high inflation rates and erratic interest rate movements. Skyrocketing oil prices, geopolitical tensions, and expansionary monetary policies all contributed to a volatile economic environment. Central banks struggled to strike a balance between containing inflation and stimulating growth. The result was a series of abrupt interest rate hikes, peaking in the early 1980s. In the United States, the Federal Reserve’s key interest rate reached a staggering 20% in 1981, as policymakers aggressively fought to curb inflation.

The 1990s and Early 2000s: Moderation

As the global economy stabilized, the 1990s and early 2000s witnessed a period of relative calm in interest rate fluctuations. Improved monetary policy coordination, technological advancements, and a shift towards inflation targeting by central banks contributed to this stability. Interest rates gradually declined and remained at moderate levels, fostering a conducive environment for sustained economic growth, especially in the developed world.

The Era of Unconventional Monetary Policy

The turn of the millennium brought about a paradigm shift in monetary policy. The 2008 global financial crisis necessitated unconventional measures to resuscitate faltering economies. Central banks resorted to near-zero or even negative interest rates, coupled with massive quantitative easing programs. The goal was to encourage borrowing and investment, thereby jumpstarting economic activity. This prolonged period of ultra-low interest rates, witnessed in major economies like the US, Europe, and Japan, had both positive and negative consequences. While it aided post-crisis recovery, it also led to concerns about financial stability and the potential for asset bubbles.

The 2010s: Historic Lows

The aftermath of the financial crisis saw interest rates plummeting to historic lows. The Federal Reserve, for instance, maintained its key rate near zero for almost a decade. This environment spurred borrowing for individuals and corporations, with an emphasis on home buying, business expansion, and stock market investment. Simultaneously, savers and fixed-income investors faced challenges in generating meaningful returns. Central banks’ efforts to promote growth often led to debates about the effectiveness of their policies in stimulating the broader economy.

Related: CEOs Roll Up Their Sleeves: Business Without Bailout

Recent Trends and the Path Forward

In the latter half of the 2010s, interest rates began a gradual ascent from their rock-bottom levels. As economies regained their footing, central banks signaled intentions to normalize policy. The challenge, however, lay in managing this transition without derailing the fragile recovery. The COVID-19 pandemic further complicated matters, prompting swift and drastic rate cuts to counter the economic fallout. As of the present day, interest rates remain relatively low, but the path ahead is uncertain, as policymakers grapple with the balance between supporting growth and preventing runaway inflation.

Related: How Have Equipment Prices Changed Since the Pandemic?

Conclusion

The last 50 years have been a remarkable journey through the ebbs and flows of interest rates. From the turbulent inflation-driven 1970s to the unconventional policies of the 2008 crisis aftermath, and the historically low rates of the 2010s, interest rates have played a pivotal role in shaping the global economic landscape. The nexus of geopolitical events, technological advancements, and shifting economic paradigms has driven these changes. As we move forward, the challenge for central banks and policymakers will be to navigate the uncharted waters of a post-pandemic world, ensuring that interest rate policies remain responsive, adaptable, and conducive to sustained economic growth.