Reshoring is the process of bringing back manufacturing operations to the United States that were previously outsourced to other countries. It involves relocating production facilities, services, or jobs from overseas locations back to the United States. While the concept of reshoring began to gain attention in the early 2000s, the trend has gained additional traction since the onset of the pandemic. In 2022, the US manufacturing industry produced $7.24TN of goods, which was a 25.5% increase as compared to a decade earlier.

One of the most significant factors fueling the reshoring trend is supply chain vulnerabilities. The COVID-19 pandemic exposed vulnerabilities in global supply chains, particularly in critical sectors such as healthcare and electronics. These supply chain issues impacted companies’ bottom lines and have forced them to reconsider the impacts of their globalized supply chain. For example, during Q3 2022, supply chain issues cost Ford an additional $1BN.

Additionally, the pandemic brought to light the geo-political risk of a globalized supply chain. With China’s zero-COVID policy, many factories were shuttered, exacerbating supply chain issues. In order to optimize their business, leaders should take a close look at their supply chain and weigh the risks and benefits of a globalized supply chain.

Related: Here’s Your Sign Financing Now is the Right Choice (and the Proof)

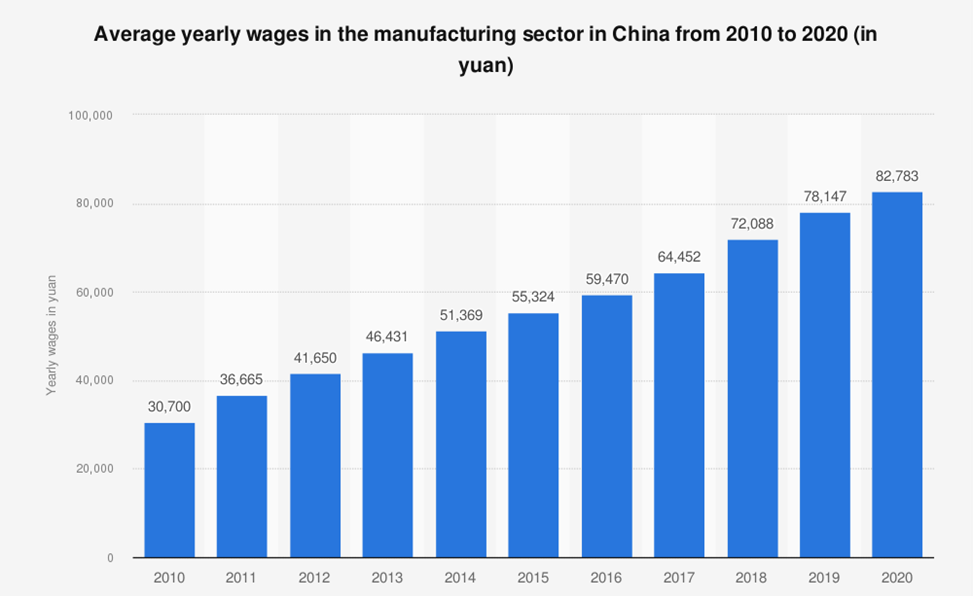

Another factor furthering the reshoring movement is rising international wages. Rising wages in some offshore manufacturing destinations, such as China, have narrowed the cost advantage of offshoring. The average yearly wage in the Chinese manufacturing sector has increased from ¥30,700 CNY ($4,336 USD) in 2010 to ¥82,783 CNY ($11,692 USD). American companies continue to reassess the economic benefits of manufacturing abroad compared to domestic production and are increasingly finding domestic production as the more appealing choice.

Related: Where is the Labor Market?

The U.S. government has implemented various measures to incentivize reshoring. For example, in August 2022, the CHIPS and Science Act was signed into law. This Act provided $280BN in new funding to promote the domestic manufacturing and development of semiconductors. These tax incentives, grants, and other financial support are aimed at encouraging companies to bring their operations back to the United States.

Trade policies and tariffs have also been adjusted to promote domestic manufacturing. During 2021, the United States generated $85BN of tariff revenue, which was a 158% increase as compared to the 2017 tariff revenue of $33BN. While tariffs encourage domestic production and reshoring, many free market economists oppose tariffs, as they serve as a barrier to trade and increase overall costs in the economy.

Improve your business with construction equipment loans, check out this article for more strategies:

While reshoring can bring certain advantages, it also presents challenges. Companies need to consider factors such as the availability of skilled labor, infrastructure, regulatory requirements, and overall competitiveness when deciding to reshore. However, the reshoring trend makes clear that more and more businesses find it advantageous to produce their goods within the United States.

A survey of CEOs conducted by management consulting company Kearney indicated that “96 percent of CEOs are evaluating reshoring their operations, have decided to reshore, or already reshored, an increase from 78 percent in 2022.”

Overall, more and more businesses are finding it optimal to reshore their manufacturing to the United States. The rising cost of labor in countries that were popular offshoring destinations, as well as supply chain vulnerabilities highlighted by the pandemic, makes reshoring a more interesting proposition than ever. Lastly, government incentives and tariffs are further encouraging the reshoring trend. EFFI is proud to support American businesses by providing Well Priced & Well Structured financing solutions, whether they have always been producing domestically or are pursuing a reshoring initiative.

Related: EFFI’s 2022 Annual Economic Review

Author: Jason Shihata, Credit Manager at EFFI Finance

SOURCES

https://fred.stlouisfed.org/series/GOMA

https://www.nytimes.com/2022/09/19/business/ford-supply-chain.html

https://www.forbes.com/sites/willyshih/2022/12/13/chinas-covid-zero-exit-and-the-potential-for-2023-supply-chain-impacts/?sh=5cae9152103f

https://www.statista.com/statistics/743509/china-average-yearly-wages-in-manufacturing/

https://www.govinfo.gov/content/pkg/PLAW-117publ167/pdf/PLAW-117publ167.pdf

https://www.csis.org/analysis/china-tariffs-digging-out-hole

https://www.kearney.com/service/operations-performance-transformation/us-reshoring-index