During 2022, our economy faced a variety of headwinds that led to increased volatility. Inflation has been, by far, the largest and most prevalent issue that our economy faced during 2022 Most of the other headwinds, such as the increasing interest rates, reduced GDP growth, and the stock market correction, were a result of inflation. Other headwinds, such as fuel price volatility and the labor shortage have furthered inflation.

Join us as we look back at the economic challenges and triumphs of 2022 and what we can learn going forward.

Inflation

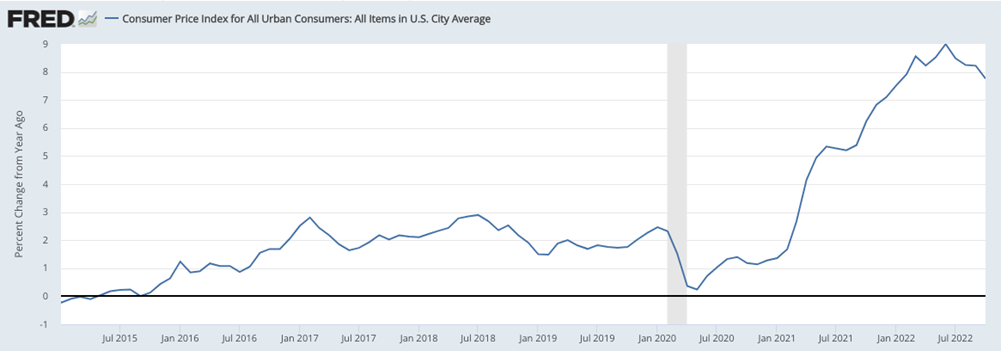

Due to robust consumer demand and supply chain issues, inflation reached a 40-year high in 2022. Typically, Federal Reserve policymakers target an annual inflation rate of 2%. However, the Consumer Price Index (CPI), the Federal Reserve’s preferred gauge of inflation, reached a peak of 8.99% for the 12 months leading up to June 2022. The CPI is based on the price of a basket of goods and services that the typical American buys. For example, CPI includes items such as food, housing, clothes, healthcare, energy, and vehicles.

The chart above shows CPI between 2015 and October 2022. Notice that during most years inflation ranges between 1% and 3%. However, in 2022 inflation ran between 7% and 9%.

There are a variety of factors driving inflation, yet two of the largest factors driving inflation were loose fiscal and monetary policy during prior months. Fiscal policy refers to government spending, while monetary policy refers to actions taken by the Federal Reserve.

Related Reading: Has Inflation Peaked?

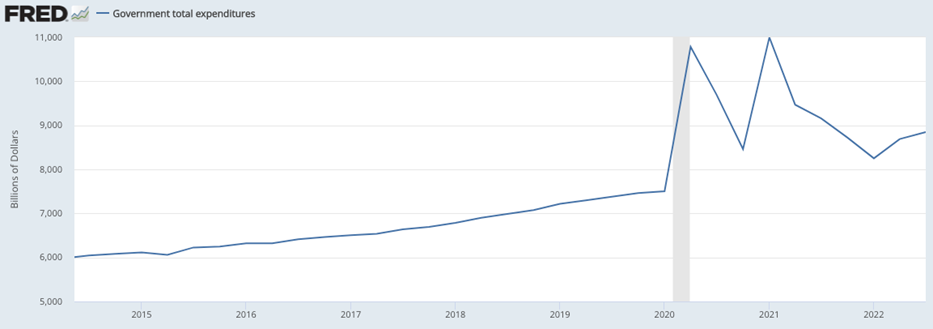

The graph below outlines the government’s quarterly spending between Q2 2014 and Q3 2022. Government spending was increasing at a relatively consistent rate leading up to Q1 2020, when the government spent $7.5 Trillion. During Q2 2020, much of the spending associated with the $2.2 Trillion CARES Act entered the economy.

The CARES Act helped keep the US economy afloat during a time when many people were laid off, many jurisdictions had stay-at-home orders, and when the general economic outlook was uncertain. Government spending increased to $10.78 Trillion during Q2 2020. Government spending decreased during Q3 2020 and Q4 2020, reaching $8,45 Trillion for Q4 2020.

Government spending increased once again during Q1 2021, to $10.99 Trillion. This increase is largely due to the $1.9 Trillion American Rescue Plan. The American Rescue Plan came at a time when nearly 80% of people who had lost their jobs during the pandemic had found new jobs and when most jurisdictions had already become familiar with managing the pandemic. The increased government spending as a result of the American Rescue Plan, during a time when the economy was already doing well, was one key factor driving inflation.

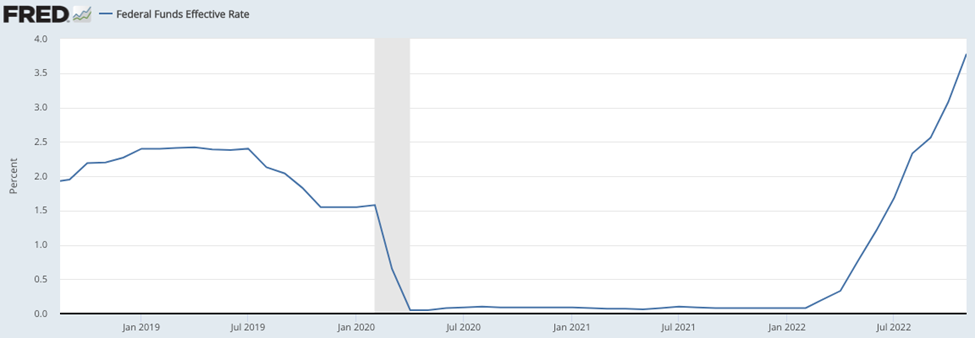

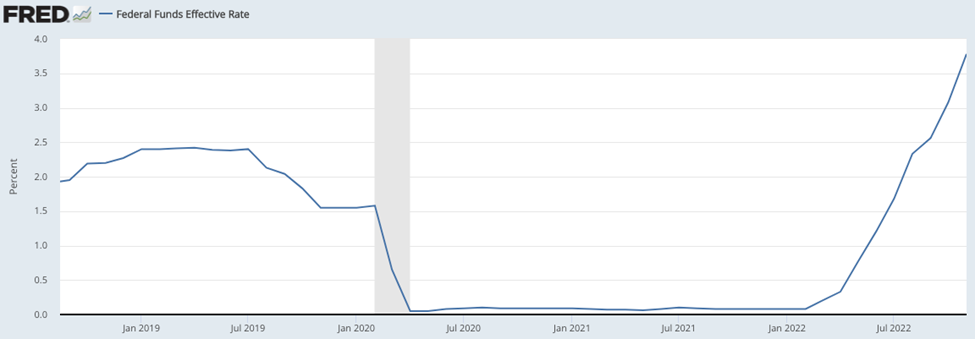

Another key factor driving inflation was loose monetary policy. As a result of the pandemic, the Federal Reserve decreased the effective federal funds rate from 1.58% in February 2020 to 0.05% in April 2020. This reduction in interest rates encouraged consumers to increase their spending and businesses to increase their capital expenditures. Effectively, by reducing interest rates during the early months of the pandemic, the Fed helped prop up the economy.

While it was justifiable to keep interest rates low during the early months of the pandemic, when economic uncertainty was high, the Fed held interest rates at near 0% until March 2022. By holding rates low after the economy rebounded, the Fed incentivized businesses and consumers to keep spending aggressively even though inflation was already above target levels.

In hindsight, the fed should have begun gradually increasing interest rates starting in Mid-2021. This would have slowed inflation much earlier and would have reduced the impact of inflation on the economy. Instead, we saw the first interest rate increase in March 2022. The chart below outlines the effective federal funds rate between September 2018 and November 2022.

Inflation is impacting both consumers and businesses alike. One EFFI client reported that their cost of labor had increased by 30% due to inflation. EFFI was successfully able to complete a nearly $31MM refinance for this client, which featured 25 different lenders and over 750 assets. This refinance allowed EFFI’s client to reduce their monthly payments by nearly $1MM, giving the client the ability to overcome their inflation-related challenges.

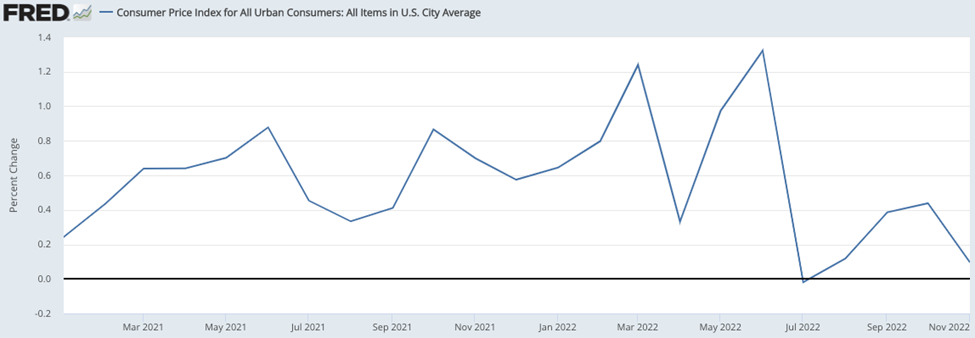

While inflation has been the most prevalent economic issue during 2022, it appears that inflation is beginning to soften. The chart below outlines the month-over-month increase in CPI between January 2021 and November 2022. Notice that the month-over-month increase in CPI was elevated between all of 2021 and the first half of 2022.

The average month-over-month CPI increase between January 2021 and June 2022 was 0.67%. However, between July 2022 and October 2022, the average month-over-month CPI increase was much lower. The average month-over-month CPI increase between July 2022 and November 2022 was 0.20%. This implies that inflation has finally peaked and is now on a downward trend.

Why take on equipment loans in the face of rising inflation?

Overall, it’s important for businesses to carefully consider the risks and benefits of taking out a loan in any economic environment, including times of high inflation. It may be helpful for a business to consult with a financial advisor or professional before making a decision. Put a meeting on our calendar to speak with the EFFI team today. Here’s some reasons why an equipment loan makes sense despite inflation.

- Invest in growth: High inflation can create opportunities for businesses to invest in expansion and growth. For example, if a company is able to secure a loan at a low interest rate, it could use the funds to invest in new equipment, hire additional staff, or expand into new markets.

- Hedge against rising costs: High inflation can also lead to rising costs for businesses, such as higher prices for raw materials, transportation, and critical equipment. Taking out a loan could allow a business to lock in funding at a fixed interest rate, which could help mitigate the impact of a volatile economic environment.

- Improve cash flow: High inflation can also lead to increased competition and pressure on margins. A loan can provide a business with additional working capital, which can help improve cash flow and allow the company to better manage its expenses.

Increasing Interest Rates

In order to combat historically high inflation, the Federal Reserve increased the federal funds rate, which is the rate that banks charge each other to lend money overnight. While business and consumer borrowing are not typically conducted at the federal funds rate, the federal funds rate impacts the rate that businesses and consumers receive.

Related Reading: Rising Interest Rates: Financing Now Can Earn Huge Returns

The effective federal funds rate has increased from 0.08% in January 2022 to 3.83% as of early December 2022. This increase occurred through seven interest rate hikes between March 2022 and December 2022. The first hike in March 2022 was a 25-basis point hike.

The second hike in May 2022 was a 50-basis point hike. The four subsequent hikes (which occurred in June, July, September, and November) were each 75-basis points. The Fed announced its last rate hike of 2022 in December, which was a 50-basis point hike.

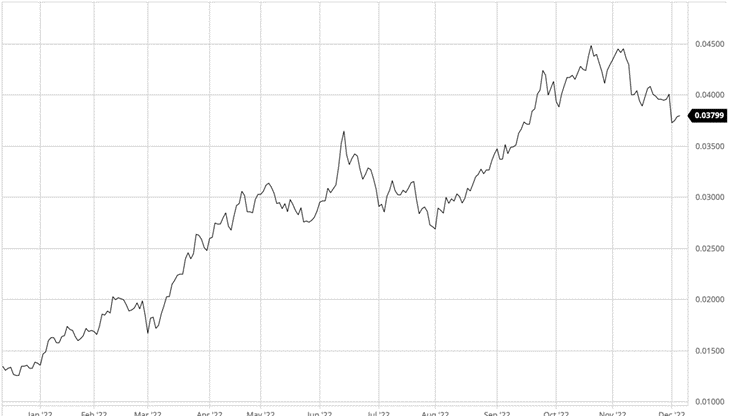

The increase in the federal funds rate has resulted in increased borrowing costs for businesses and consumers. The 5-year interest rate swap, which serves as the basis for many of EFFI’s fixed rate deals, increased from 1.36% in January 2022 to 3.73% as of December 1st, 2022.

Should I lock in lower interest rates now for an equipment loan?

The increasing federal funds rate could present an opportunity for businesses to consider taking out a loan now. Here are a few potential reasons why:

- Lock in a lower interest rate: If a business anticipates needing to borrow money in the future, taking out a loan now could allow the company to lock in a lower interest rate. As the federal funds rate continues to rise, the interest rates that businesses and consumers receive on loans are likely to increase as well. By borrowing now, a business may be able to secure a more favorable interest rate and potentially save money over the long term.

- Improve cash flow: A loan can provide a business with additional working capital, which can help improve cash flow and allow the company to better manage its expenses. This can be especially important in an environment where the cost of borrowing is rising and there is increased pressure on margins.

Put a meeting on our calendar to speak with the EFFI team today.

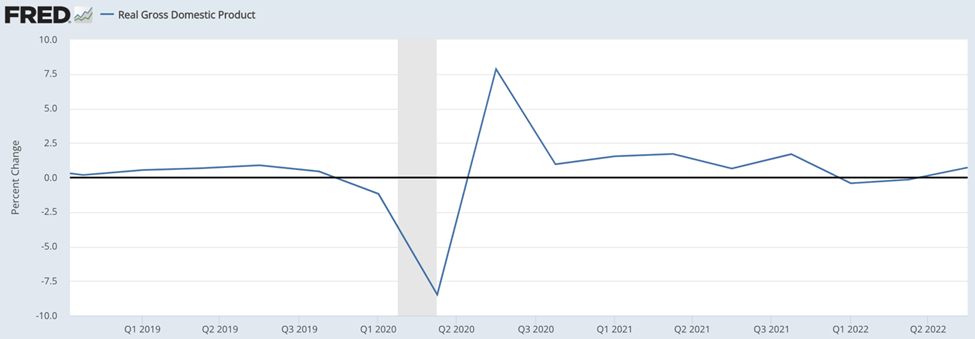

Reduced Economic Growth

As a result of the rampant inflation and economic uncertainty, overall spending was reduced during the first half of 2022. Quarter over quarter real GDP, which is adjusted for inflation, contracted by 0.41% during Q1 2022 and 0.14% during Q2 2022. Real GDP grew by 0.72% during Q3 2022. Overall, this means that GDP was relatively flat for 2022.

Many financial observers often cite the rule of thumb that two consecutive quarters of negative real GDP growth represents a recession. This coincides with the fact that, historically, every time we recorded two quarters a recession was declared. Yet for 2021, this was not the case.

In reality, the National Bureau of Economic Research (NBER) is the official arbiter of recessions. This means that if the NBER does not declare a recession, we are not in an official recession. The NBER defines a recession as, “A significant decline in economic activity that is spread across the economy and that lasts more than a few months.”

The NBER uses data such as real personal income less transfers (PILT), nonfarm payroll employment, real personal consumption expenditures, wholesale-retail sales adjusted for price changes, employment as measured by the household survey, and industrial production in their decision-making process.

Related Reading: 5 Reasons Equipment Financing Makes Great Business Sense

The NBER concedes that “There is no fixed rule about what measures contribute information to the process or how they are weighted in (their) decisions.” There are several reasons why the NBER doesn’t utilize the two-quarter definition for GDP.

One reason is that the NBER prefers to utilize a range of factors, rather than solely real GDP growth, to analyze the health of the economy. Additionally, the NBER considers the depth of the economic decline. Since the depth of the decline during the first half of 2022 was relatively shallow and other key data points suggested a continued expansion, the NBER did not declare a recession.

One reason for the reduced growth during 2022, was the increase in interest rates. Higher interest rates encouraged businesses and individuals to adjust their spending habits, because of the increased borrowing costs.

Why take out an equipment loan during reduced national economic growth?

Here are a few potential reasons for why a business might want to consider taking out an equipment finance loan in the face of economic uncertainty:

- Investment in productivity: Even during times of economic uncertainty, businesses may still need to invest in equipment and other assets to improve productivity and efficiency. An equipment finance loan can provide a business with the funds it needs to make these investments, which could ultimately help the company weather economic challenges and emerge stronger in the long term.

- Preservation of cash: In times of economic uncertainty, businesses may be hesitant to tie up their cash in large equipment purchases. An equipment finance loan can provide a way for a business to acquire the equipment it needs without depleting its cash reserves.

- Tax benefits: Equipment finance loans may offer tax benefits, such as the ability to write off the interest paid on the loan as a business expense. This could make the loan a more financially attractive option for a business.

It’s important to note that taking out a loan is a significant financial decision and businesses should carefully consider the risks and benefits before proceeding. It may be helpful to consult with a financial advisor or professional before making a decision. Put a meeting on our calendar to speak with the EFFI team today.

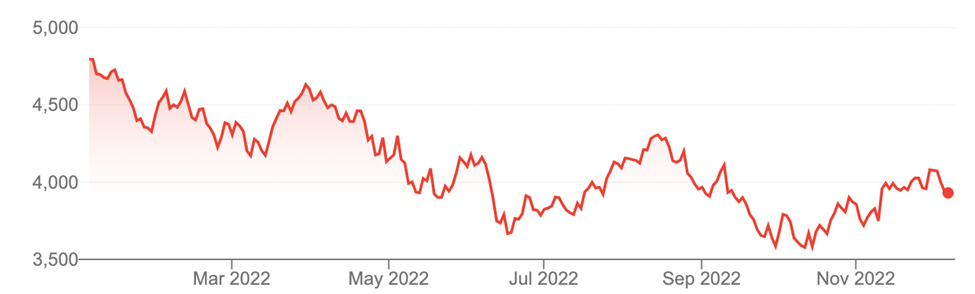

Stock Market Correction

During 2022, the stock market entered correction territory. Between January & November 2022, the S&P 500 decreased in value by approximately 15%. At its lowest, the S&P 500 was down by over 25% on October 13, 2022. During late October and November, the S&P 500 experienced a return to growth.

S&P 500

One key reason why the stock market declined was the increase in interest rates. Increasing interest rates negatively affect stock prices for a plethora of different reasons. One reason why an increase in interest rates causes stock prices to go down is that businesses, privately owned and publicly traded alike, often utilize debt to fuel their growth. As the cost of borrowing increases, businesses are faced with higher costs and likely lower profits.

Another reason why increasing interest rates leads to a decline in the stock market is that fixed-rate debt investments become more appealing to investors. For example, the yield on a 1-year treasury bill increased from 0.40% at the beginning of January 2022 to 4.74% at the end of November 2022.

The increase in yield for fixed-rate investments resulted in some investors substituting investments in the stock market for fixed-rate investments. The reduced in-flows into the stock market, as a result of a higher return on fixed-rate investments, contributed to the decline in the stock market.

A further reason why increasing rates caused the stock market to decrease in value during 2022 is that investors who use a discounted cash flow investment strategy would inevitably need to decrease their price targets.

In a nutshell, investors who utilize a discount flow strategy discount the company’s current and future earnings relative to a discount rate (such as a treasury bill). As these discount rates increase, the perceived stock value for these discount cash flow investors would decrease. Therefore we would expect these investors to reduce their investments.

The decrease in the stock market is attributable to increasing interest rates. Since increasing interest rates can be traced back to the elevated level of inflation, the decrease in the stock market is ultimately due to inflation. This explains why when a key inflation indicator comes in below expected, we see a modest rally in the stock market.

How does the stock market decline affect my decision to finance equipment?

The current economic environment, characterized by rising interest rates and a decline in the stock market, might make equipment finance loans an attractive option for businesses looking to secure financing and avoid relying on the volatile stock market for funding.

Our report shows that the stock market experienced a significant decline in value during 2022. The status of the stock market is more useful as an indication of the larger economic issues at hand, ie. increasing interest rates and inflation. These factors negatively impact businesses and disrupt the stock market as a whole. Financing your equipment and locking down current prices and rates now, while other businesses are not in a position to do so, has the potential to provide some stability and predictability in terms of the cost of borrowing.

Put a meeting on our calendar to speak with the EFFI team today.

Fuel Prices

Fuel prices were highly volatile during 2022. A barrel of West Texas Intermediate oil was valued at $76.02 at the beginning of the year. Oil prices increased at a moderately consistent rate between January and late February 2022, closing at $91.59 as of February 24th, 2022. Oil prices surged between late February and early March, as markets grappled with the impact of the Russian invasion of Ukraine.

Oil prices peaked at a high of $129.44 on March 7th, 2022. Oil prices remained highly volatile between early March and early June, as a result of the uncertainty caused by the Russia-Ukraine conflict. Between early June and September 2022 oil prices began a volatile price decrease, reaching a low of $76.42 on September 26, 2022.

Oil prices spiked again during October, reaching $93.31 on October 6th, 2022 and remained elevated during the month. During November and the first week of December, oil prices decreased rapidly, reaching $71.46 as of December 7th, 2022. While oil prices were highly volatile during 2022, as of the first week of December, oil prices were a few dollars lower than at the beginning of the year.

WTI Crude

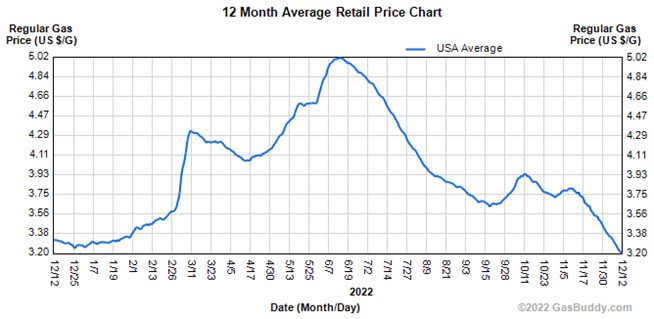

The average price for a gallon of regular gas followed a similar general trend to the average price of a barrel of oil. However, gas prices tended to lag oil prices and were much less volatile. The average price of a gallon of gas peaked a $5.02 in mid-June 2022. The average gas price decreased to $3.20 by early December, approx. matching gas prices at the start of the year.

How do fuel prices affect my decision to finance equipment?

The volatile nature of fuel prices during 2022 demonstrates the importance of having reliable and efficient equipment. With fuel prices fluctuating so dramatically, it is likely that businesses that rely on transportation or the use of heavy machinery have felt the impact on their bottom line. Investing in new or upgraded equipment through an equipment loan may allow these businesses to mitigate some of the financial strain caused by fluctuating fuel prices by using more fuel-efficient or alternative-fuel equipment. Additionally, having newer, more reliable equipment can also reduce the need for costly repairs or downtime, which can further help businesses save money in the long run.

Put a meeting on our calendar to speak with the EFFI team today.

Labor Market

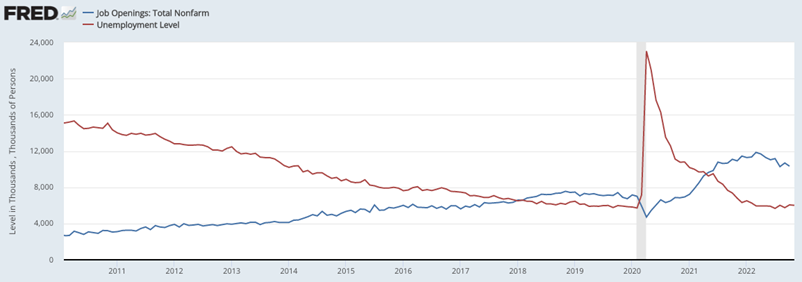

While the labor market remains historically tight, businesses continue to hire new employees. During March 2022 there were a record number of job openings, at 11.8MM openings. In contrast, the unemployment level (which is measured as the number of people who are available and seeking employment), was only 5.9MM.

This means that for every unemployed American, there were approx. 2 open jobs. In order to compete in the tight labor market, employers began increasing their wages, which has also contributed to an increase in inflation.

Fortunately for businesses, the gap between job openings and the unemployment level is shrinking. As of October 2022, there were 10.3MM job openings and 6.0MM unemployed workers. This means that for every unemployed American, there were approx 1.7 open jobs. While this is still considered a very tight labor market, it seems to be improving. The chart below outlines the unemployment level (in red) and the total nonfarm job openings (in blue).

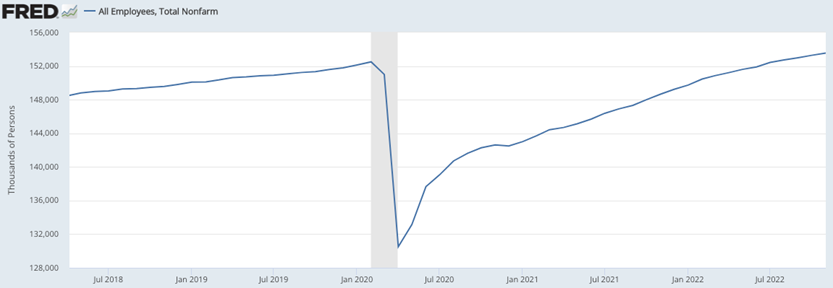

During 2022, our economy finally returned to the same employment level as pre-pandemic. During February 2020, there were 152MM employed Americans. During the height of the pandemic-related uncertainty, the total number of employed Americans decreased to 130MM in April 2020.

In subsequent months the economy began re-adding jobs rapidly, yet by the end of 2020, the number of jobs added began to taper off. At the start of 2022, the economy employed 149MM Americans, which was approx 3MM less than the pre-pandemic peak. As of November 2022, the economy employed 153MM Americans, which was slightly more than the pre-pandemic peak.

How does the employment rate affect my decision to finance equipment?

Our report indicates that the economy has returned to pre-pandemic levels of employment, and is even slightly exceeding those levels. The labor market remains historically tight, with a high number of job openings and relatively low unemployment.

This suggests that businesses are hiring and expanding, which may require them to purchase new equipment or upgrade their existing equipment in order to stay competitive and meet increased demand. Taking out an equipment loan can help businesses access the equipment they need to grow and succeed in a tight labor market.

An equipment loan can provide the necessary financing to take advantage of these opportunities and support the growth of the workforce with new and better equipment.

Conclusion

While our economy faced a variety of headwinds during 2022, the majority of these challenges are either a product of inflation or a source of inflation. The Federal Reserve increased interest rates 7 times during 2022, to combat inflation.

Economic growth slowed during 2022, as the increasing interest rates encouraged a reduction in spending. The increase in interest rates also contributed to a correction in the stock market. The surge in fuel prices during mid-2022 helped drive inflation even higher. Lastly, the tight labor market pressured businesses into increasing wages, further exacerbating inflation.

The end of 2022 shows some optimism. Inflation seems to have peaked during mid-2022, with inflation running closer to target levels for the last few months of the year. The Federal Reserve’s interest rate-rising campaign seems to be slowing down, which is positive for the stock market and general economic growth. Fuel prices also decreased significantly during the later months of the year. While 2022 was a challenging year, our economy remains resilient.

Put a meeting on our calendar to speak with the EFFI team today.

Author: Jason Shihata, Credit Manager at EFFI Finance