Given the rising interest rate environment, many businesses planning equipment acquisitions are faced with crucial decisions.

Federal Reserve officials have forecasted an average federal funds rate of 1.9% for 2022. The federal funds rate serves as a benchmark interest rate that determines the cost of borrowing for many loans. After the recent May 4th interest rate hike (the largest increase since 2000), the federal funds rate currently sits at 0.75% to 1.0%, indicating that interest rates are likely to increase by an additional 1% during this year.

As such, we find ourselves asking the question: Is it better to finance now at a lower rate, or finance later at a higher rate? We believe that choosing to finance now at a lower interest rate is a great option for most businesses.

From an interest savings perspective, it will always be preferable to finance now rather than later during a rising interest rate environment.

However, businesses must decide whether the interest savings is worth the upfront cash flow tradeoff. The decision to finance now or finance later ultimately comes down to how highly the business values cash flow in earlier months.

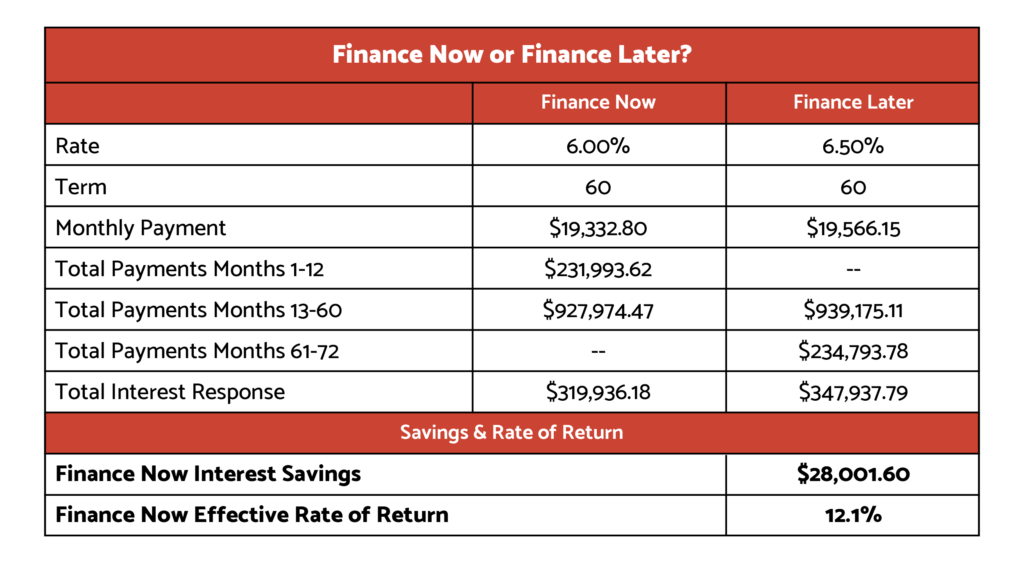

Scenario #1: How much will a 0.50% increase cost me?

- Business A and Business B finance $1MM of equipment with a 60-month term.

- Business A chooses to finance now and locks in a 6.00% interest rate.

- Business B chooses to finance in 12 months and locks in a 6.50% rate (as compared to 7.00% in scenario #1).

Related News: The Fed recently approved a 0.50% interest rate increase to fight inflation and some Fed officials are advocating for raising the target closer to 2.5% by the end of the year.

In the above scenario, Business A saves $28.0k of interest, as compared to Business B, the business that chose to finance later. Business A begins making payments today and makes $231.9k of payments during the first year. Business B chooses to finance later and doesn’t begin making payments until the 13th month.

Business A, the business that chooses to finance now effectively receives $28.0k of interest savings for the $231.9k cash flow commitment during the first 12 months, allowing for an effective rate of return of 12.1%.

Additionally, Business B will have to make $234k of payments during the 6th year, while the company that chooses to finance now will not.

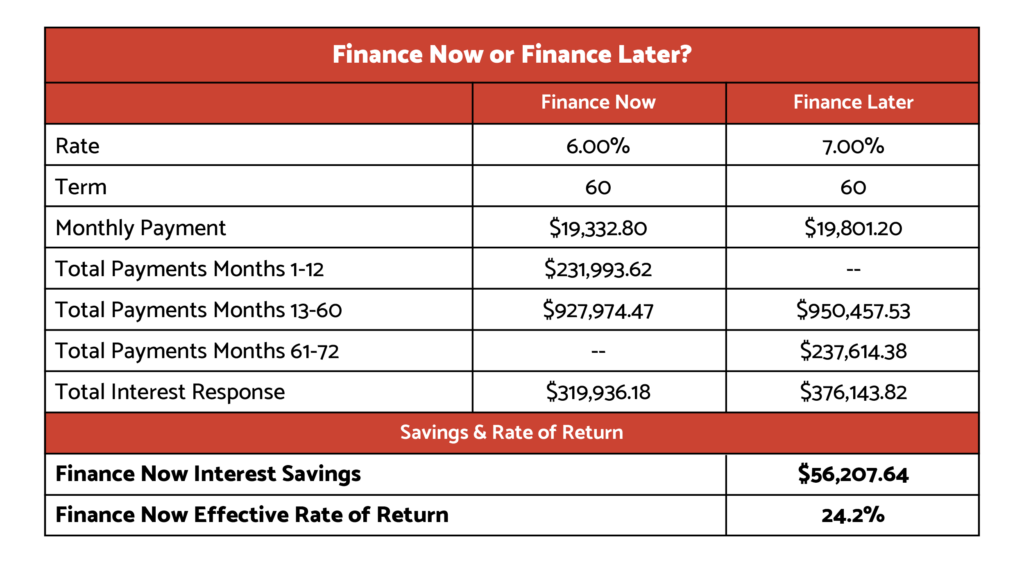

Scenario #2: How much will a 1.00% increase cost me?

- Business A and Business B finance $1MM of equipment with a 60-month term.

- Business A chooses to finance now and locks in a 6.00% interest rate.

- Business B chooses to finance later and waits 12 months and locks in a 7.00% rate.

In the above scenario, Business A, the company that chooses to finance now saves $56.2k of interest, as compared to Business B. Business A begins making payments today and makes $231.9k of payments during the first year.

Business A effectively receives $56.2k of interest savings for the $231.9k cash flow commitment during the first 12 months, allowing for an effective rate of return of 24.2%.

Additionally, Business B will have to make $237k of payments during the 6th year, while the company that chooses to finance now will not.

Financing Before Additional Rate Increases is the Shrewd Move

In both of the above scenarios, the business that chose to finance now was able to secure a significant reduction in interest expense, as compared to the business that chose to finance later. When the interest rates increased by 1.0%, Business A was able to save $56k in interest, implying a 24.2% return on the cash flow required for the first 12 months of payments. When interest rates increased by 0.5%, Business A was able to secure a more modest interest savings of $28k, implying a 12.1% return.

If you are a business with liquidity to pay upfront, financing before the industry increase is the smart way to go because it has the potential to save you substantially in interest expenses. For more interest rate information, schedule a strategy session with EFFI to consult an expert in business financing.