During the first six months of 2022, our economy faced multiple new headwinds including interest rate increases, a stock market correction, persistent inflation, as well as elevated fuel prices. Despite these headwinds, businesses continued to hire more employees, as the labor shortage begins to subside.

Interest Rate Increases

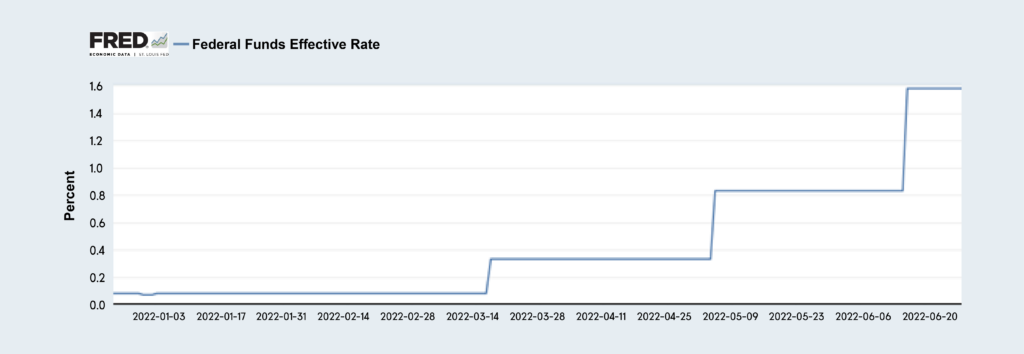

During the first half of 2022, we saw the Fed increase interest rates significantly, to combat unprecedented inflation.

The Fed hiked interest rates three times during the first half of 2022.

- The first hike was a 25-basis point increase in mid-March.

- The second hike was a 50 basis point increase during early May.

- The third hike was the most substantial, a 75 basis point increase in mid-June.

The June hike represents the largest interest rate hike since 1994. The effective federal funds rate increased from 0.08% in January to 1.58% in June.

Interest rates are anticipated to continue to increase for the remainder of 2022. According to the CME FedWatch Tool, markets were pricing in a 7% chance for a 150 basis point increase between July 2022 and December 2022, a 39% chance of a 175 basis point increase, a 44% chance for a 200 basis point increase, and a 10% chance of a 225 point increase.

The increasing federal funds rate has resulted in higher borrowing costs for businesses and consumers. The 5-year interest rate swap, which serves as the basis for many of EFFI’s fixed rate deals, increased from 1.49% to 3.08% between January and June.

Stock Market Correction

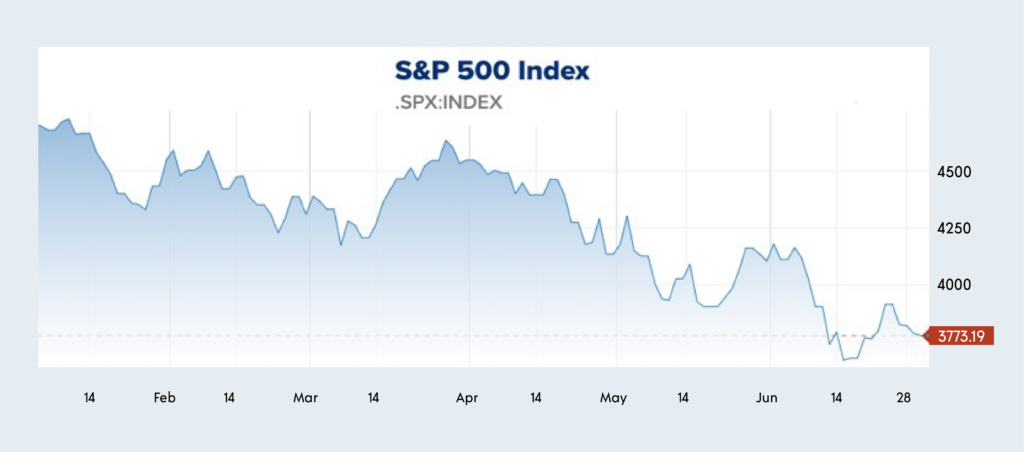

As a result of declining investor sentiment, the S&P 500 posted its worst first half since 1970. The S&P 500, which encompasses 500 of the largest publicly traded companies, decreased from $4,793 in January to $3,778 by the end of June. This represented a decline of over 20%.The decrease in the stock market was due to a variety of factors including interest rate increases, reduced earnings from many tech firms due to the January Omicron slowdown, persistent inflation, as well as a reduced macroeconomic outlook.

Persistent Inflation

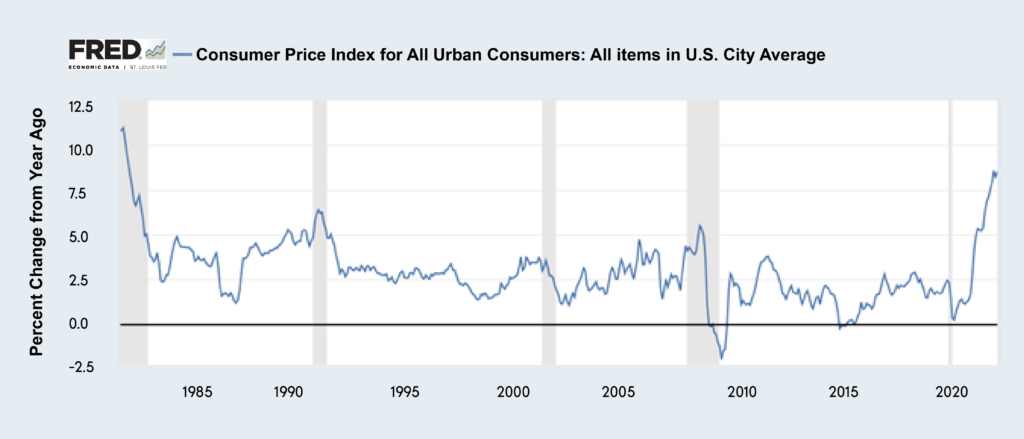

During the first 6 months of 2022, persistent inflation became one of the most prominent economic issues. While the Fed previously dismissed the elevated inflation levels as transitive, suggesting that it was only a temporary phenomenon caused by supply chain issues, we saw a shift in this stance during late 2021 and early 2022.Inflation, as measured by the consumer price index reached 8.55% in March 2022. This was the highest level of inflation since 1981.

The high inflation during the first six months of 2022 is due to strong consumer demand and supply chain challenges for manufacturers. The Fed has made controlling inflation one of its key focuses. This explains why the Fed has increased rates significantly during the first half of the year.

Elevated Fuel Prices Due to the Russian Invasion of Ukraine

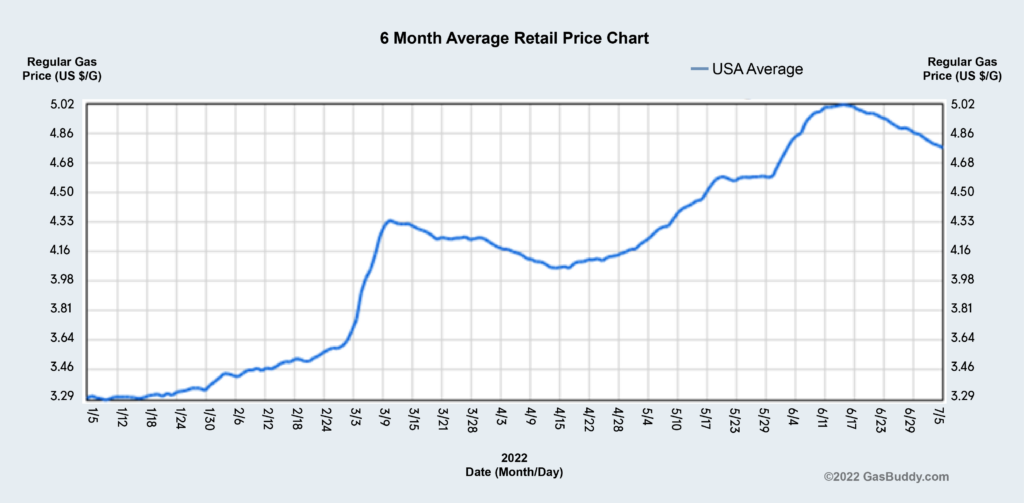

As a result of Russia’s invasion of Ukraine, fuel prices skyrocketed during the first 6 months of 2022. The average price of a gallon of regular unleaded gasoline increased from $3.29 in January to $5.02 in early June. Fuel prices decreased slightly in late June.

The June 2022 fuel prices are the highest ever recorded.

Some states such as California faced even higher averages, where the average price of a gallon of regular unleaded reached $6.43. The elevated fuel prices can largely be attributed to many nations placing sanctions on Russia. Some countries, such as the US, banned imports of Russian oil.

Globally, Russian oil volume represents 11% of the global supply. Other factors contributing to increased fuel prices include tight supply and rebounding demand.

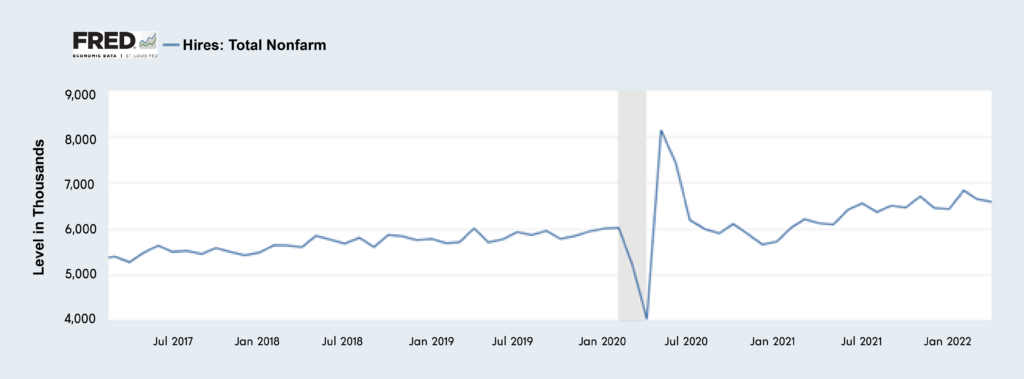

Increased New Hires

Despite the headwinds that we saw in the first half of the year, businesses have become better able to manage the labor shortage. The number of monthly new hires increased to over 6.5MM for early 2022. Pre-pandemic, the average number of new hires averaged less than 6MM per month. While staffing remains an issue for many companies, as more and more Americans return to the labor force, we are seeing labor becoming less of an issue than in prior months.

Conclusion

While persistent inflation, a stock market correction, increasing interest rates, and elevated fuel prices contribute to increased economic uncertainty, businesses continue to hire more people. The headwinds that our economy is facing make equipment finance a compelling choice for businesses still poised for growth yet prefer to keep more cash on their balance sheets. Additionally, businesses who are beginning to see cash flow challenges should consider a refinance before interest rates further increase.

Related: Rising Interest Rates: Financing Now Can Earn Huge Returns