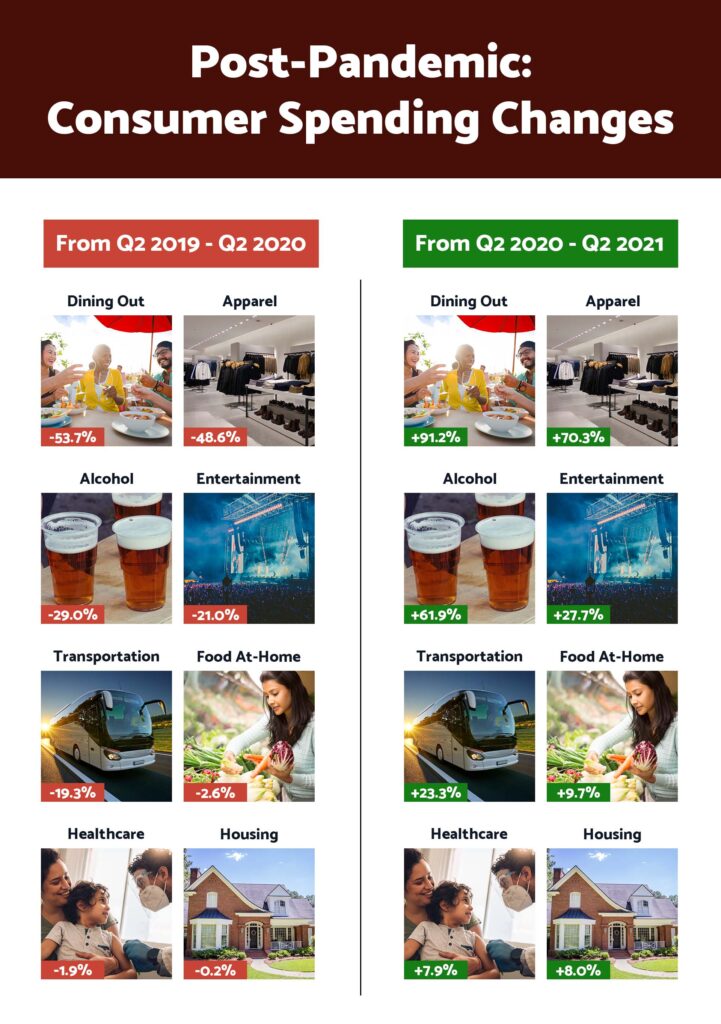

In many areas of the economy, the pandemic resulted in a yo-yo effect on consumer spending. During the early months of the pandemic, when Americans had fewer spending opportunities and uncertainty was higher, they spent less. As our economy re-opened, buoyed by multiple stimulus packages, American consumers endeavored on a spending spree, the likes of which we had never seen before.

Related Reading: How Will the Russian Invasion of Ukraine Impact the US Economy?

Dining Out

The largest decrease in spending during the pandemic was on dining out. Americans spent on average 53.7% less on food away from home during Q2 2020, as compared to Q2 2019. Spending in this category improved significantly between Q2 2020 and Q2 2021, increasing by 91.2%. The initial decrease in spending was likely due to the closure of indoor dining in some areas.

Apparel and Services

Spending on apparel and services also decreased significantly during the pandemic, as Americans working from home did not need to purchase as much business clothing and chose to reduce discretionary spending. Between Q2 2019 and Q2 2020 spending on apparel and services decreased by 48.6%. Between Q2 2020 and Q2 2021, spending on apparel and services increased by 70.3%.

Alcoholic Beverages

Spending on alcoholic beverages decreased by 29.0% between Q2 2019 and Q2 2020. However, spending on alcohol was unique. When we more closely look at the data, we realize that the reduction in alcohol spending came mostly as a result of a reduction in spending at bars. In place of spending money at costly bars, consumers spent more on lower-cost alcohol purchases for home. Spending on alcohol increased by 61.0% between Q2 2020 and Q2 2021, partially due to the reopening of bars.

Entertainment

Spending on entertainment decreased by 21.0% between Q2 2019 and Q2 2020, largely as the result of the cancellation of many live events, such as concerts and sporting events. As sporting events and concerts became open to the public once again, spending on entertainment increased by 27.7%.

Transportation

As a result of widespread work from home policies, as well as low fuel prices for those that continued to commute to work, spending on transportation decreased by 19.3% between Q2 2019 and Q2 2020. As more Americans returned to in-person/hybrid work models and fuel prices increased, spending on transportation increased by 23.3%.

Dine In

Spending on food at home decreased slightly during the early months of the pandemic. The average American spent 2.6% less on food at home during Q2 2020, as compared to Q2 2019. This may be due to consumers opting for lower-cost options. Between Q2 2020 and Q2 2021 spending on food at home increased by 9.7%, which is partially due to increasing food costs.

Healthcare & Housing

Spending on healthcare and housing both decreased by less than 2.0% between Q2 2019 and Q2 2020. Between Q2 2020 and Q2 2021, spending on healthcare and housing increased by approx. 8%, roughly matching the annual inflation rate for this period.

Trends from Publicly Traded Retailers

While segmented data is not yet available for more recent periods, we can use earnings data from publicly traded retailers in order to understand how Americans have been spending their money in recent months.

Walmart Q2 2022 – Consumers Buying Low-Margin Goods

Walmart, the largest retailer in the nation, generated $141.5BN of revenue during its first quarter of 2022, which surpassed analyst expectations of $138.94BN. However, the company’s earnings per share (EPS) of $1.30 during Q1 2022 were below analyst expectations of $1.48 per share.

Walmart attributed the increased sales and decreased profitability to consumers opting to purchase more low-margin goods, such as eggs, private label deli meats, and half gallons of milk. Additionally, increased supply chain costs have contributed to reduced profitability.

Target Q2 2022 – Underperforming EPS

Target fared similarly to Walmart, with Target’s revenue of $25.17BN for its first quarter of 2022 surpassing expectations of $24.49BN. However, Target’s EPS of $2.19 was significantly lower than analyst expectations of $3.07 per share. Target blamed the earnings miss on supply chain issues, increased staffing costs, as well as a shift in merchandise mix.

Dollar Tree Outperforms Larger Retailers

Low-priced retailer Dollar Tree performed better than the larger retailers, generating $6.90BN of revenue during the first quarter of the year. This surpassed analyst expectations of $6.77BN. Dollar Tree’s EPS was $2.37, also surpassing analyst expectations of $1.98. They attributed their success to hiking prices, offering more expensive goods, increasing its private fleet of trucks, and adding self-checkout to more locations. Dollar Tree’s CEO mentioned that their core customers have been shopping more intentionally and the next tier of customers is starting to shop with them a bit more.

In summary, we saw the ‘V-Shaped’ economic recovery for some sectors as well as a ‘U-shaped’ economic recovery for others. The key determining factor was not about resources, it was about consumer access to reach these markets. Today, with the economic recession looming, we are paying close attention to where the consumer will choose to allocate their resources based on what is anticipated to be limited resources to allocate.

Related Reading: Rising Interest Rates: Financing Now Can Earn Huge Returns