10-minute read

While 2022 was a volatile year, with inflation reaching the highest level in over 40 years and the Fed hiking interest rates 7 times, we head into 2023 with some optimism. Inflation is expected to cool and interest rate hikes are expected to slow. Our economy is expected to grow, even if at a slower rate. Additionally, we expect the tight labor market to continue improving.

Declining Inflation

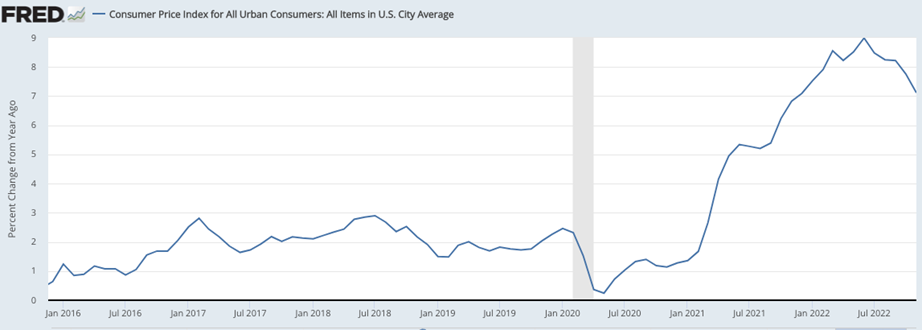

During 2022, inflation reached its highest level since 1981. While the typical target inflation rate is 2% per year, inflation (as measured by CPI) reached a peak of 8.99% for June 2022. CPI measures the percent change in price for a market basket of goods that the typical American buys. This market basket includes shelter, food, fuel, apparel, and healthcare.

Record high inflation of 8.99% in June 2022, measured by CPI tracking the typical American’s market basket of goods.

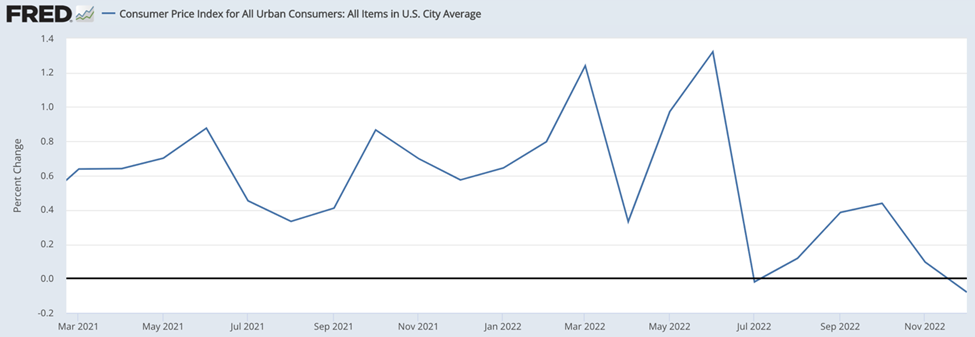

Fortunately, inflation began to subside towards the second half of 2022. The average monthly CPI increase during the first half of 2022 was 0.88%. In contrast, the average monthly CPI increase for the second half of 2022 was 0.16%. This implies that inflation slowed down significantly during late 2022.

Inflation subsided in late 2022, with monthly CPI increasing 0.16% compared to 0.88% in the first half.

We expect the slowing inflation trend to continue into 2023. While 2023 inflation may remain above target levels, inflation appears to be responding to the tighter monetary policy. Our expectation for 2023 inflation is between 2.5% and 4.5%, based on the general trend in inflation.

Fewer Interest Rate Hikes

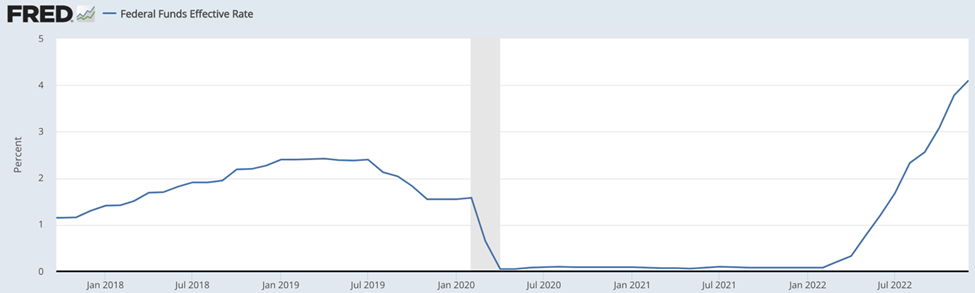

As a result of accelerated inflation, the Federal Reserve increased interest rates 7 times during 2022. This brought the effective federal funds rate up from 0.08% in January 2022 to 4.10% as of December 2022.

Seven rate hikes by Fed in 2022 raised funds rate from 0.08% to 4.10% by Dec, in response to accelerated inflation.

In their December 2022 meeting minutes, the Federal Reserve Open Market Committee (FOMC) said that they anticipate “ongoing increases in the target range will be appropriate in order… to return inflation to 2 percent over time.” Therefore, we expect interest rates to remain higher in 2023, as compared to the pandemic lows.

Related: Post-Pandemic Consumer Spending Trends: What are People Spending Money On?

As far as how many hikes to expect, the FOMC was less clear. The committee said that they would pay attention to factors such as inflation when adjusting their stance on monetary policy. Since inflation is receding, we expect the number of interest rate hikes to dwindle during 2023. We are expecting to see 2-3 interest rate hikes during 2023. These hikes are likely to be 25 basis points each, yet we may also see a 50-basis point hike.

We may even see one or two small rate cuts during late 2023. This likelihood will depend on how responsive inflation is to the interest rate hikes, as well as how the broader economy responds. The decreasing inflation trend and slower economic growth make it seem possible to see a cut in late 2023. If we see a rate cut in 2023, we’ll likely see renewed investor confidence and stronger growth into 2024.

Positive, Yet Low GDP Growth

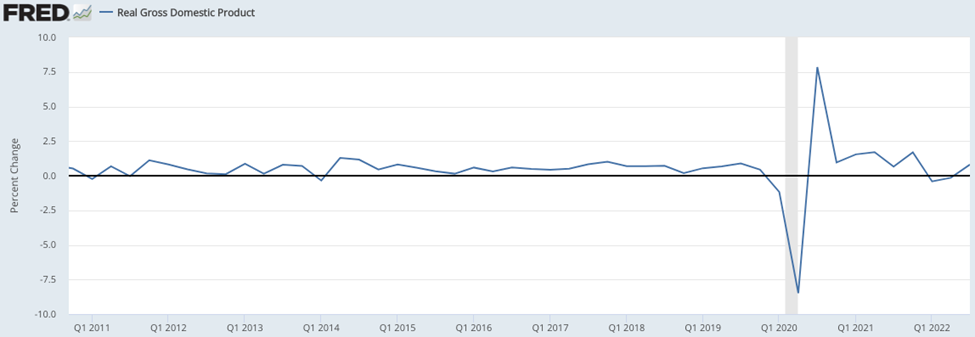

During the first 9 months of 2022, real GDP (which is adjusted for inflation) grew by 0.2%. GDP represents the final value of all goods and services produced within a country.

GDP growth was negative for the first two quarters of 2022, as the economy grappled with high inflation and the impact of increasing interest rates. GDP growth returned to positive figures for Q3 2022. Q4 GDP results have yet to be published at the time of writing.

GDP grew 0.2% in first 9 months of 2022, after negative growth in first 2 quarters due to high inflation and interest rates.

We expect 2023 growth to be slightly better than what we saw during the first three quarters of 2022. One reason why we expect GDP growth to be slightly better than 2022 is that inflation appears to be improving. This will give businesses and investors increased confidence to pursue projects and growth initiatives. Additionally, we expect that the reduced number of interest rate hikes, as well as the potential for interest rate cuts, will improve the 2023 growth outlook.

Related: Rising Interest Rates: Financing Now Can Earn Huge Returns

We expect 2023 GDP growth to be in the 0.5-1.5% range. This would be lower than the recent average GDP growth of approx. 2% per year, yet still better than the first three quarters of 2022.

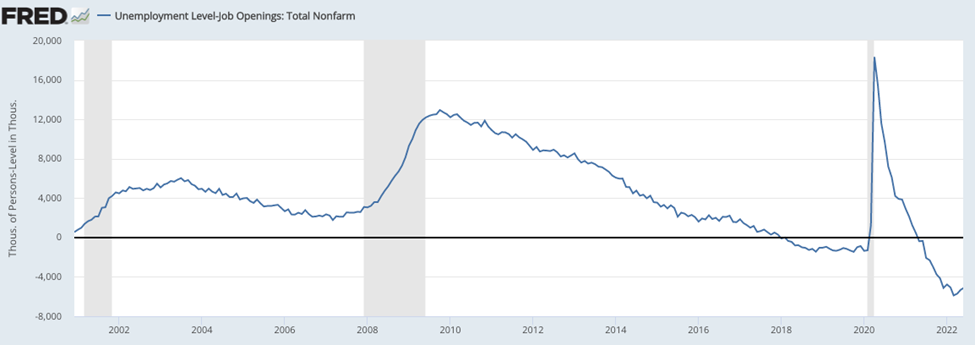

Largest labor shortage in 2022: 5.8MM more job openings than unemployed Americans in March. Pushed up wages and caused hiring challenges.

Typically, the number of available jobs is more than the number of unemployed Americans. This means that we usally have a labor surplus. Prior to the pandemic, this dynamic shifted, with approximately 1.3MM more jobs than unemployed workers in February 2020.

The uncertainty caused by the pandemic caused many businesses to reduce their headcount, with 18.3MM more unemployed Americans than open jobs in April 2020. The labor surplus decreased relatively swiftly, with the number of jobs exceeding the number of unemployed by May 2021. The labor shortage peaked in March 2022, with 5.8MM more jobs than unemployed Americans.

Related: The Impact of the Pandemic on the Labor Market: Who Left and Why?

The good news is that the labor shortage began to subside towards the end of 2022. As of November 2022, there were 4.4MM more job openings than unemployed Americans. While this is still high by historical standards, it is a roughly 25% improvement from the peak.

We anticipate that the labor shortage will continue to improve during 2023. This will reduce wage pressures for employers and will allow employers to secure the labor that they need.

Earnings Expectations

American Airlines, the largest airline in the world by fleet size, provided guidance for adjusted earnings per share of $2.50 to $3.50 for 2023. This represents a significant improvement from the $0.19 adjusted earnings per share for fiscal year 2022. The company attributes the significant improvement in earnings guidance due to demand trends and fuel price forecasts.

Concrete Pumping Holdings, the parent company of Brundage-Bone Concrete Pumping & Capital Concrete Pumping, provided a 2023 revenue expectation of $420MM to $445MM. Additionally, the company is projecting adjusted EBITDA of $125MM to $135MM for fiscal year 2023. The company’s 2023 revenue projection represents an approx. 5-10% increase as compared to fiscal year 2022. Similarly, the company’s fiscal year 2023 adjusted EBITDA is an approximately 6-11% increase as compared to the fiscal year 2022 adjusted EBITDA.

Take advantage of the construction industry’s growth and improve your business with construction equipment loans, check out this article for more strategies:

Knight-Swift Transportation, one of the largest trucking companies, provided guidance for adjusted earnings per share (EPS) of $4.05 to $4.25 for 2023. This represents a moderate decrease from the fiscal year 2022 adjusted EPS of $5.03. The company cited downward pressure on truckload rates as one reason for the lower adjusted EPS guidance for 2023.

Kraft Heinz expects 2023 organic net sales growth of 4-6% as compared to fiscal year 2022. Similarly, the company is expecting adjusted EBITDA growth of 2-4% for fiscal year 2022. The company intends to use the increased margin to invest in technology, marketing, and people. Lastly, GE expects 2023 revenue growth to be in the high single digits. GE expects their adjusted EPS to increase significantly during 2023, from $0.77 in 2022 to $1.60-$2.00 for 2023. The company reports that they are, “Confident in strong market demand & operational improvements across businesses.”

Conclusion

The most significant trend that we anticipate our economy will face in 2023 is declining inflation. This will allow for a slowdown in interest rate hikes and may even allow for a small interest rate cut at the end of 2023. While 2023 GDP growth may be lower than historical averages, we expect GDP growth to remain positive. Most industry-leading businesses are expecting continued revenue and cash flow growth during 2023. Lastly, we expect the labor shortage to continue to subside. Therefore, we enter 2023 with some optimism.

Related: EFFI’s 2022 Annual Economic Review

Author: Jason Shihata, Credit Manager at EFFI Finance

SOURCES

https://www.morganstanley.com/ideas/global-macro-economy-outlook-2023

https://fred.stlouisfed.org/series/CPIAUCSL

https://fred.stlouisfed.org/series/FEDFUNDS

https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20221214.pdf

https://fred.stlouisfed.org/series/UNEMPLOY

https://www.concretepumpingholdings.com/news-events/press-releases/detail/70/concrete-pumping-holdings-reports-strong-fourth-quarter-and

https://s24.q4cdn.com/286931391/files/doc_financials/2022/q4/Fourth-Quarter-2022-Earnings-01-26-2023.pdf

https://news.aa.com/news/news-details/2023/American-Airlines-Reports-Fourth-Quarter-and-Full-Year-2022-Financial-Results-CORP-FI-01/default.aspx#:~:text=Guidance%20and%20investor%20update&text=Based%20on%20today’s%20guidance%2C%20American,be%20between%20%242.50%20and%20%243.50

https://americanairlines.gcs-web.com/news-releases/news-release-details/american-airlines-reports-fourth-quarter-and-full-year-2022

https://news.kraftheinzcompany.com/press-releases-details/2023/Kraft-Heinz-Reports-Fourth-Quarter-and-Full-Year-2022-Results/default.aspx

https://www.ge.com/sites/default/files/2023-ge-investor-conference-presentation.pdf